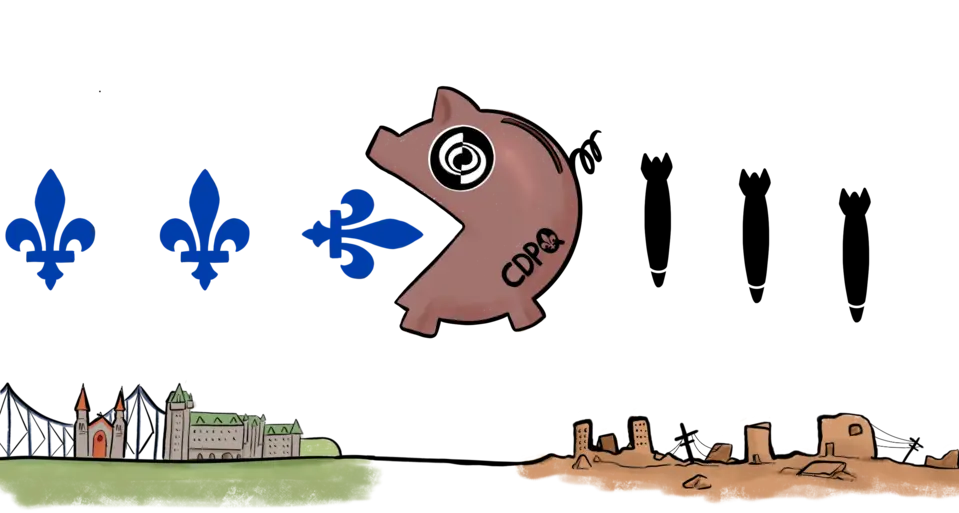

CDPQ's Complicity

What is the CDPQ?

The Caisse de dépôt et placement du Québec (CDPQ) was created in 1965 by the National Assembly to manage the collective savings of Quebecers. It is Quebecers’ nest egg.

With more than $473 billion in assets under management, CDPQ is Canada’s 2nd largest pension fund.

It manages the funds of 48 public organizations. These depositors are mainly public pension funds and insurance plans.

More than 6.5 million Quebecers pay into or receive benefits from these funds. For example, all employees pay a portion of their wages to the Quebec Pension Plan and the CNESST, Québec’s workers compensation board.

CDPQ’s main depositors

CDPQ invests in human rights violations

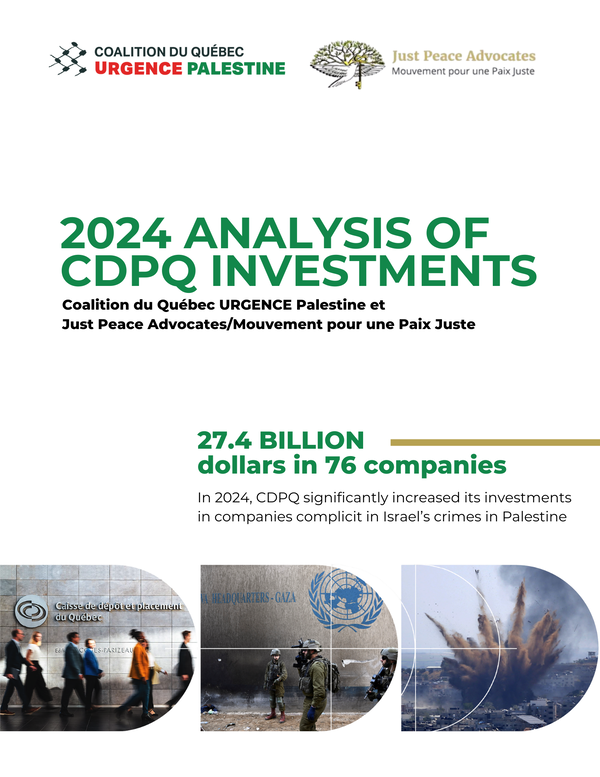

As of December 31, 2023, CDPQ had $27.4 billion invested in 76 companies around the world that are complicit in violations of international law and crimes against the Palestinian people. This represents an increase of 24% on the previous year and 5.8% of total investments, which amount to $473.3 billion.

These 76 companies can be found on one or more of the six lists of companies identified as complicit in crimes against the Palestinian people: the United Nations database, the AFSC Investigate project, Canada : Stop Arming Israel, Who Profits, Don’t Buy Into Occupation and Campaign Against Arms Trade.

To find out more, see the Analysis of the 2024 Annual Report produced jointly by the Quebec Coalition URGENCE Palestine and the Just Peace Advocates on April 30, 2025.

Examples of complicit companies

CDPQ must take action

CDPQ must ensure that all its investments comply with international law.

It has two options: pressure the complicit companies to immediately cease all activities that violate international law (e.g. WSP Global) or sell its holdings (e.g. Lockheed Martin).

Divestment is possible!

CDPQ has sold investments with negative social or environmental impacts in the past.

The tobacco industry

In 2020, CDPQ withdrew entirely from the tobacco industry.

Fossil industries

In 2022, the Sortons la Caisse du carbone campaign led CDPQ to completely pull out of oil production.

Policity

In 2023, the Québec BDS Coalition got CDPQ to divest from Policity because of its violations of Palestinian human rights.

The Norwegian example

KLP, Norway's largest pension fund, has made several divestments in recent years.

In April 2021, KLP, Norway’s largest pension fund, divested from 16 companies, including Alstom, because of their involvement in Israeli settlements in the West Bank.

In June 2024, KLP sold its investment in Caterpillar because of its role in violations of human rights and international law in Palestine.

If KLP can do it, so can and must CDPQ !

Double standards

CDPQ claims its investments meet the highest ethical standards. When Russia invaded Ukraine, CDPQ quickly sold its Russian stocks.

Why won’t CDPQ do the same for Palestine?